A Beginner’s Guide to Using Credit Card Points for Travel

Ever wondered how people travel more for less or fly first class for the price of economy? The secret is credit card points. Using points for travel is a powerful tool for savvy travelers, and you don’t need to be an expert to get started.

In this beginner’s guide, we’ll break down how credit card points work, how you can earn them, and most importantly—how to use them to book your dream vacation!

Travel Goals

When it comes to earning credit card points and miles, having a clear understanding of your travel goals is key. Whether you’re planning a luxury getaway, family vacation, or want to maximize everyday purchases, defining your travel goals helps you choose the best credit cards and earn more rewards.

Are you a couple looking to book your honeymoon? Is your family looking to book free hotels for road trips? are you looking to book a couples trip to Europe? Identifying what type of travel you would like to do is key before you get started.

What Are Credit Card Points?

Credit card points are rewards you earn by spending money on your credit card. Many credit cards, particularly travel rewards cards, offer points for every dollar spent. These points accumulate and can be redeemed for a variety of travel-related expenses, like flights, hotel stays, car rentals, and even experiences like excursions or dining.

There are two main types of travel points:

- General Travel Points: Earned through programs like Chase Ultimate Rewards®, American Express Membership Rewards®, or Citi ThankYou® points. These points are often more flexible and can be transferred to a variety of airline and hotel partners.

- Frequent Flyer Miles: Points that are specific to a particular airline’s rewards program, such as Delta SkyMiles, United MileagePlus, or American Airlines AAdvantage. These can be redeemed directly with the airline, often for flights or upgrades.

How to Earn Credit Card Points for Travel

Sign-up Bonuses

Many travel credit cards offer generous sign-up bonuses after you meet a minimum spending requirement. For example, a card might offer 50,000 points after you spend $3,000 in the first three months. This is often enough for a free round-trip flight or a couple of nights at a hotel!

How do I meet this minimum spend?

You might be wondering how you are going to meet this minimum spend requirement especially if the number is high. First, put all of your household monthly expenses on your credit card that you just opened. Groceries, gas, dining out, cable bill, etc. ALL OF IT onto your new credit card. By strategically putting all of your monthly spend on your new card (for you and your spouse, family) you would be suprised how quickly you can meet this minimum spend. Especially if you have a big expense you are paying for such as a wedding, medical bills, new furniture etc.

I have reached the minimum spend – how do I continue to earn more points?

Continue to earn more points with your everyday expenses! Most travel credit cards offer at least 1 point per dollar spent on general purchases. But certain categories—like dining, travel, or groceries—can earn you extra points, sometimes up to 3x or 5x the points. For example, the American Express Gold Card® earns 4x points per dollar on groceries and restaurants!! Think about all the points you can rack up from just your monthly grocery bill!

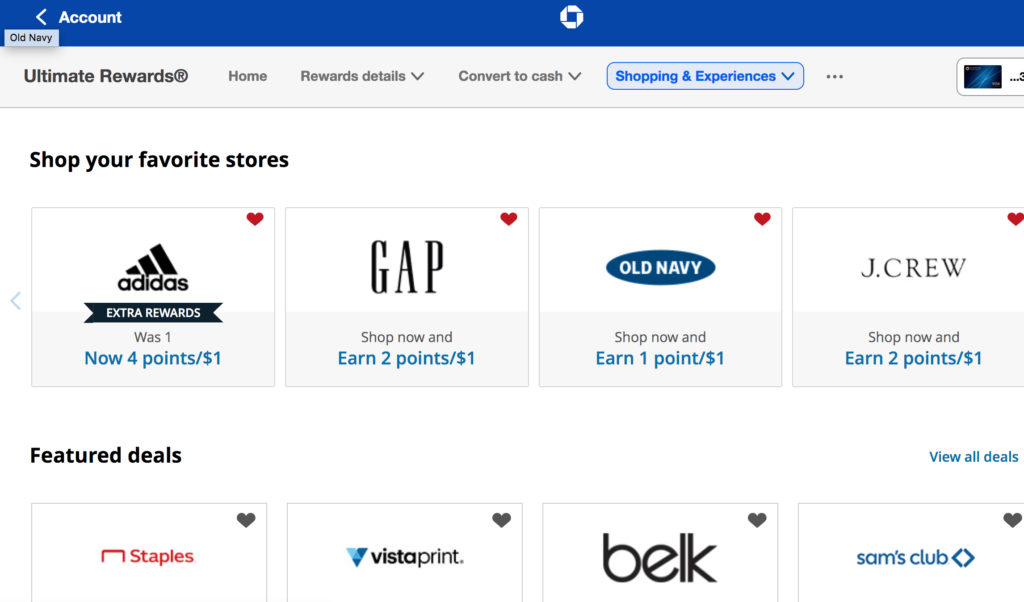

Shopping Portals

A shopping portal is an online platform, usually run by credit card issuers or loyalty programs, where you can earn bonus points or miles when shopping at participating retailers. It’s like an extra layer on top of your regular credit card points, helping you earn more with every purchase.

How do shopping portals work?

- Log in to the Shopping Portal: You first need to log in to the shopping portal associated with your credit card or loyalty program. For example, if you have a Chase Sapphire Preferred® card, you would visit the Chase Ultimate Rewards Shopping Portal. If you have an American Express Gold Card® you can link it to Rakuten to earn more membership rewards points!

- Browse Retailers: Once logged in, you’ll be able to browse through the participating retailers. These stores will have various point multipliers listed next to them (e.g., 5x points, 10x points, etc.).

- Click Through to Shop: To earn the bonus points, you need to click on the retailer’s link from the portal, which redirects you to the retailer’s website. It’s important not to visit the retailer’s site directly—doing so ensures the portal can track your purchase.

- Make Your Purchase: After clicking through, you shop as usual, adding items to your cart and checking out. When the purchase is confirmed, the shopping portal tracks your transaction and credits the bonus points to your account.

- Earn Extra Points: In addition to the regular points from your credit card, you’ll also earn bonus points through the shopping portal. The number of bonus points varies depending on the retailer.

How to Redeem Credit Card Points for Travel

Travel Portal Redemption

Most credit card issuers offer travel portals where you can redeem points for flights, hotels, car rentals, and more. For example, Chase Ultimate Rewards® points can be used through the Chase Travel Portal, with a redemption value of 1.25 to 1.5 cents per point, depending on your card.

- Pro Tip: Some cards offer better value when redeeming through their portals. For example, if you have the Chase Sapphire Preferred® card, your points are worth 25% more when redeemed through the Chase Travel Portal.

Transfer Points to Airline or Hotel Partners

One of the most powerful features of travel rewards points is their ability to be transferred to airline and hotel partners. This is how I redeem almost ALL of my points!

Major travel programs like Chase Ultimate Rewards®, American Express Membership Rewards®, and Citi ThankYou® let you transfer points to a variety of partners. This includes airlines like Delta, United, and British Airways, as well as hotel chains like Marriott, Hyatt, and Hilton.

A popular way to redeem your Chase Ultimate Rewards® points is to transfer them to the World of Hyatt Program. This is an easy and beginner friendly way to get the most value out of your points! Read more about how to do this here!

Another way to redeem your American Express®, Citi Thank You®, and Capital One Points® is to transfer them to popular airline programs such as AirFrance, Delta, British Airways, and more! Read more about how to do this here.

- Pro Tip: Transferring your points at first may seem intimidating. Using a search tool like point.me can walk you through how to do this!

Pay with Points for Travel Purchases

- If you’ve already booked a flight or hotel, many credit cards let you pay with points. Cards like the Capital One Venture® and Venture X® allow you to apply points as a statement credit for travel expenses. This is a fast way to use points, though the value may be lower than transferring to a partner.

Credit Card Annual Fees

When shopping for a travel rewards credit card, the annual fee is one of the first things you’ll notice. While some cards have no fee, many top travel cards charge an annual fee ranging from $95 to several hundred dollars.

Is the annual fee worth it? It depends. In this post, we’ll explain everything you need to know about travel credit card fees—what they are, what benefits they offer, and how to decide if the fee is worth it for your travel goals.

What is a Travel Credit Card Annual Fee?

A travel credit card annual fee is a fee that you pay once a year just for holding and using the card. This fee is charged regardless of whether you use the card for purchases or not. Travel credit cards with annual fees tend to offer more robust rewards, greater travel perks, and premium benefits than those without fees.

Here’s a quick look at the general breakdown of fees:

- No annual fee: Often offers basic rewards and limited benefits.

- Low annual fee ($95 – $150): Typically provides a solid rewards structure with some travel benefits, like lounge access or insurance coverage.

- High annual fee ($450 – $695): Offers premium travel benefits, such as higher rewards rates, exclusive lounge access, priority boarding, free checked bags, and access to luxury travel services.

Do You Really Need a Travel Credit Card with an Annual Fee?

Whether or not you should opt for a travel card with an annual fee depends on how much value you’re likely to get from the card’s rewards and perks. Let’s look at some factors to consider:

The Value of Rewards

Some credit cards with annual fees offer bonus points for spending in categories like travel, dining, or groceries. For example, a card with a $95 fee might give 2x points on travel, while a higher-fee card could offer 5x points on travel and dining.

The Perks and Benefits

Many travel cards with annual fees offer valuable perks like:

- Airport lounge access: The Chase Sapphire Reserve® gives you access to Priority Pass lounges, worth over $400 annually.

- Global Entry/TSA PreCheck credits: The Platinum Card® from American Express offers up to $100 in statement credits for TSA PreCheck or Global Entry.

- Travel insurance and protections: Premium cards often include trip cancellation, baggage delay, and lost luggage coverage.Free checked bags: Cards like the Citi® / AAdvantage® Platinum Select® Mastercard® offer free checked bags, saving you up to $100 per round trip.

- Hotel and car rental perks: Some cards offer elite hotel status or discounts on car rentals, adding extra value to your travels.

When considering whether the annual fee is worth it, tally up the value of these perks. If they offer more value than the annual fee, then the card may be a good fit.

Travel Goals and Spending Habits

Your travel goals and spending habits should guide your choice. If you travel often, stay at hotels, or dine out, a card with higher rewards or travel perks may be worth it. But if you only travel occasionally, a card with a low or no annual fee could be a better option.

After I earn the sign up bonus what do I do with my credit card?

After having your travel rewards credit card for one year, you will need to assess whether it is worth it to keep a card with an annual fee. These are your three options:

- Keep the card and continue to earn points

- A lot of times you can justify the annual fee with all of the perks you are receiving from the card. For example, the World of Hyatt personal card has a $95 annual fee, BUT it comes with a free night award. For me, I know I will stay at a Hyatt hotel each year, which makes the annual fee worth it to me. Especially since I can redeem a free night that is worth way more than $95!

- Downgrade the card to a no annual fee card

- A lot of times credit cards with annual fees have an option to downgrade to a no fee card. This may be a good option since this will not affect your credit score.

- Cancel the card

- If you have a card that has a high annual fee that you can no longer justify you may need to cancel the card. Just make sure that you have had the card for a full year before cancelling.

Popular Travel Credit Cards for Beginners

- Chase Sapphire Preferred® Card: Great for beginners due to its ease of use and high-value points.

- Capital One Venture Rewards Credit Card®: Earn unlimited 2 miles per dollar on every purchase, which is simple and easy to track.

- American Express® Gold Card: Ideal for foodies, with 4x points on dining and restaurants.

- Citi Premier® Card: Offers a good value for general travel purchases and a solid bonus category structure.

Final Thoughts: Start Earning and Redeeming Today!

Using credit card points for travel is a smart way to save money on flights, hotels, and more. By choosing the right card and maximizing your points, you can unlock amazing travel experiences without spending extra. Start with a card that fits your needs, and soon you’ll be booking your trips with points earned from everyday purchases.

This beginner’s guide is packed with tips to help you get started with using credit card points for travel, whether you’re looking for your next big adventure or just a weekend getaway.